Wall Street’s 3 Favorite Warren Buffett Dividend Stocks to Own Today

Warren Buffett, the Oracle of Omaha, will step down as CEO of Berkshire Hathaway on January 1, 2026. That said, he’s not retiring - he’s staying on as chairman, which is just a classic Warren Buffett move. With 70 years of trading experience, the man has changed the landscape of value investing - and investing as a whole.

So, it’s no surprise that many follow Buffett’s investment picks. Perhaps it's a new investor seeking ideas, or a retiree looking to diversify their retirement portfolio. The point is, the Oracle of Omaha knows what he’s about, and his stock picks usually turn out to be great choices. Otherwise, Berkshire Hathaway would still be a textile company, or, more likely, it wouldn’t even exist today.

But there are dozens of stocks in Warren Buffett’s portfolio… which ones should you pick?

Today, let’s look at the top dividend-paying stocks in Berkshire Hathaway’s asset list and see which ones Wall Street likes best.

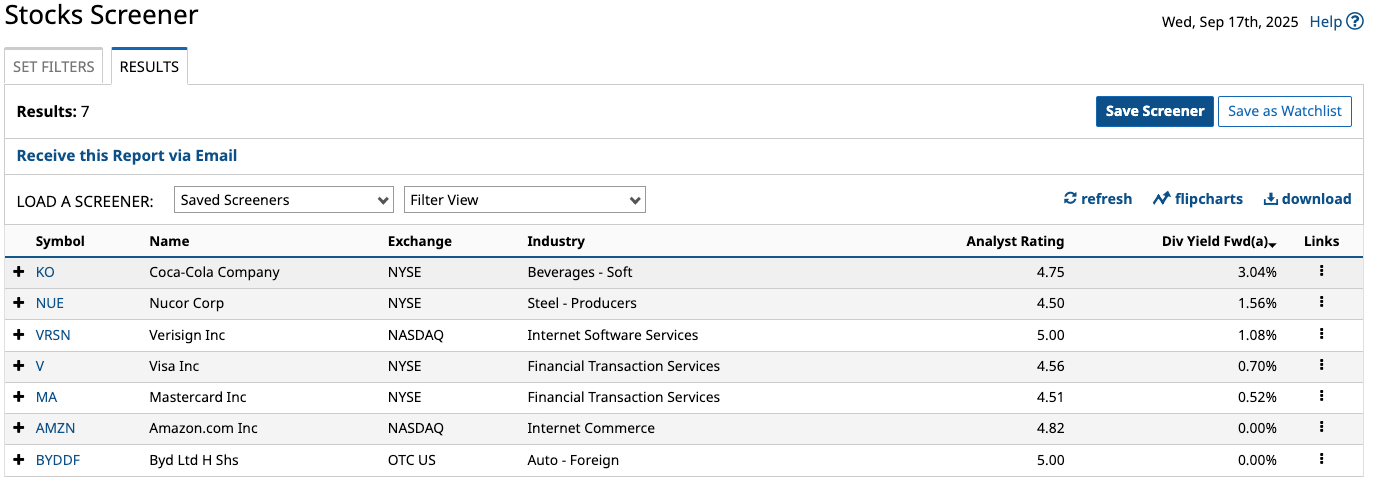

How I Found The Following Stocks

To get my list, I started on Barchart’s Investing Ideas page, where several themed and categorized lists are available for every investor. The criteria for lists here range from industry types to specialized charts and technical analysis highlights, such as which stocks are displaying the Golden Cross pattern or which penny stocks are showing the most significant change.

From there, I used the Warren Buffett stocks list, then went straight to the Stock Screener and used the following filters:

- Current Analyst Ratings: 4.5 to 5 (Strong Buy). This filter takes all analyst ratings on stocks and consolidates them into an average, which is then ranked based on a 1-5 scale. Strong-buy-rated stocks are some of the very best ones, at least according to Wall Street.

- Annual Dividend Yield (Forward): Left blank so I can arrange the results accordingly.

With these simple filters in place, I ran the screen and got seven companies, arranged from highest to lowest yields.

Without further ado, let’s start with number one:

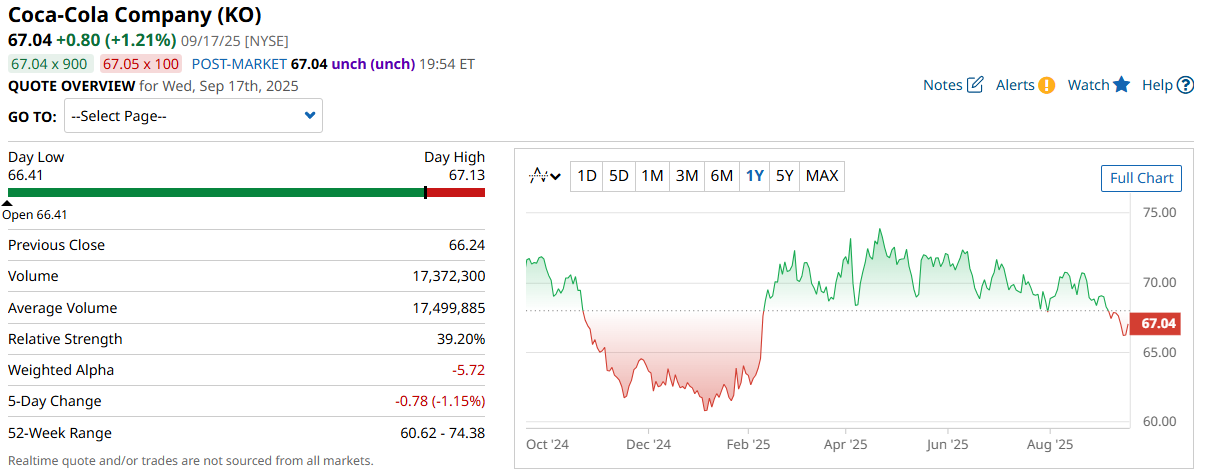

Coca-Cola Company (KO)

No surprise here; Coca-Cola is at the top of the list. The beverage behemoth has operations and distribution networks that solidify its presence worldwide. I’ve been around a lot of places, and let me tell you, when you ask for a Coke, everyone knows what you’re talking about.

Today, this Dividend King pays 51 cents per share quarterly, which translates to $2.04 annually, or approximately a 3% forward yield. That’s decent enough for most investors, and the fact that the company’s 5-year dividend growth (21.25%) is close to its 5-year revenue growth (26.28%) might make the deal all the sweeter.

Plus, a consensus among 24 analysts rate KO stock a strong buy with a 4.75 average score, further cementing Coca-Cola’s status as one of the best dividend stocks in the market and one of Buffett’s top investments.

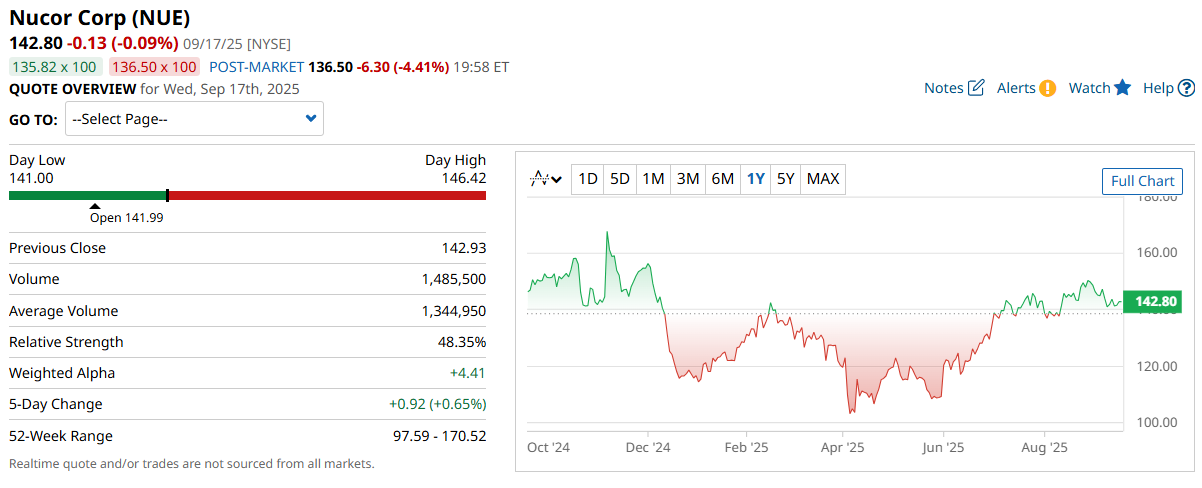

Nucor Corp (NUE)

Nucor Corporation is the largest steel producer and scrap recycler in North America. Now, that might not be as exciting as the latest AI stocks out there, but I think many investors are missing this one key detail: AI data center construction is ramping up, and they will need steel. With Nucor sitting at the top of the food chain, many firms will be lining up for its products, which is potentially why Berkshire Hathaway has it in its portfolio.

Aside from its growth prospects, Nucor is also a Dividend King, boasting 52 consecutive years of dividend payout increases. Today, the company pays $0.55 quarterly, which translates to $ 2.20 per share per year, or approximately a 1.5% forward yield.

It also has a strong buy consensus rating from 14 analysts, and its average score has been trending upward over the last three months, indicating that Wall Street is quite bullish on NUE stock.

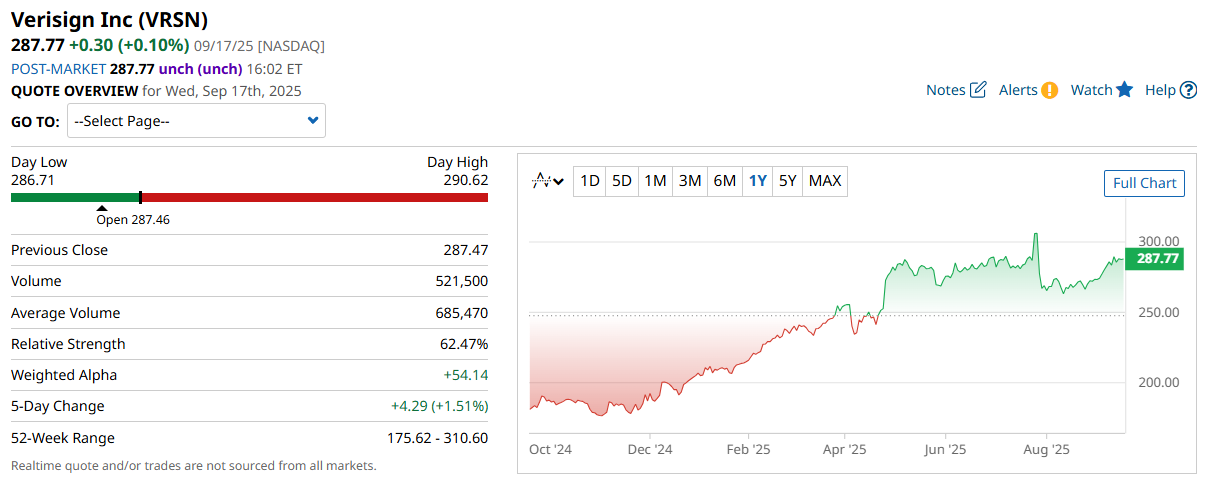

Verisign Inc (VRSN)

Last on the list is Verisign. Unlike the other two, which I’ve covered at least once or twice before, Verisign is a breath of fresh air. The company provides internet infrastructure services, including domain registration for .com and .net websites, the two most popular top-level domains (TLDs) on the internet.

Verisign’s been around for a while, but the reason why it hasn’t been featured in one of my top dividend stock lists is, well, because it only recently announced an updated dividend policy. As per the company’s Q1’25 financials released back in April, “Verisign intends to continue to pay a cash dividend quarterly, subject to market conditions and approval by Verisign’s Board of Directors.”

Verisign pays 77 cents quarterly, which reflects a $3.08 forward annual rate and around a 1% yield. What got me even more excited about it is its 8.99% dividend payout ratio. While there are no immediate indications that the company intends to increase its payouts in the future, the low ratio gives it considerable headroom to grow should it choose to do so.

Aside from that, VRSN stock has a consensus strong buy rating from Wall Street analysts, although coverage is still limited, with only two analysts covering the stock. Still, Berkshire Hathaway owns shares; add that to the recent dividend development, and like Mikey - I already like it.

Final Thoughts

There’s no shame in copying the greats. In fact, I’m willing to bet that many investors have secured their financial futures by imitating Warren Buffett’s portfolio over the years.

However, this doesn’t exclude you from due diligence. Buffett and Berkshire Hathaway may have more experience and resources than your typical retail investor, which automatically makes them trusted authorities on the matter, but you need to make sure that the stocks you’re buying fit your investment goals. So, don’t neglect your research.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.